Part I: China’s Vacuum Sanitation Sector – A $2.1 Billion Market Poised for 14% CAGR Growth Through 2030

China’s vacuum toilet industry is experiencing a structural boom driven by three converging megatrends: **water scarcity, green-infrastructure mandates, and off-grid urbanization**. According to MOHURD, the nation’s per-capita renewable water resources stand at just **2,042 m³—barely 28% of the global average**. By 2035, **16 of China’s 34 provincial-level regions will face “extreme water stress”**. Vacuum sanitation, which slashes flush volumes from 6–9 L to **0.7–1.0 L per use**, has emerged as the most scalable retrofit for high-traffic public nodes.

The market itself is compact but high-margin. In 2024, China’s installed base of vacuum systems surpassed **180,000 units**, generating **RMB 14.8 billion ($2.1 bn)** in system sales and aftermarket revenue (CCID Consulting). Analysts forecast a **14.3% CAGR through 2030**, propelled by:

- Policy tailwinds – The 14th Five-Year Plan mandates all new municipal facilities in water-stressed cities adopt **≤1.0 L/flush technology by 2027**.

- Rail & aviation electrification – High-speed rail (45,000 km by 2035) requires **zero-discharge onboard systems**.

- Off-grid industrial corridors – Demands sanitation that operates reliably from **-50°C to +50°C** without municipal hookups.

- Circular-economy incentives – MOHURD grants **RMB 1,200–1,800 per m³** of verified annual water savings.

Vacuum toilets are a regulatory and **ESG compliance cornerstone**. The technology’s **98% lower water footprint** and **98.7% lower energy draw (0.0025 kWh/flush)** versus gravity systems make it the default choice for LEED-Platinum public projects. Yet the market remains fragmented: domestic players own **71% of terrestrial installations**. This is where ZNZK has engineered a decisive lead.

Part II: ZNZK – Engineering Dominance Through Patents, Scale & Extreme-Environment DNA

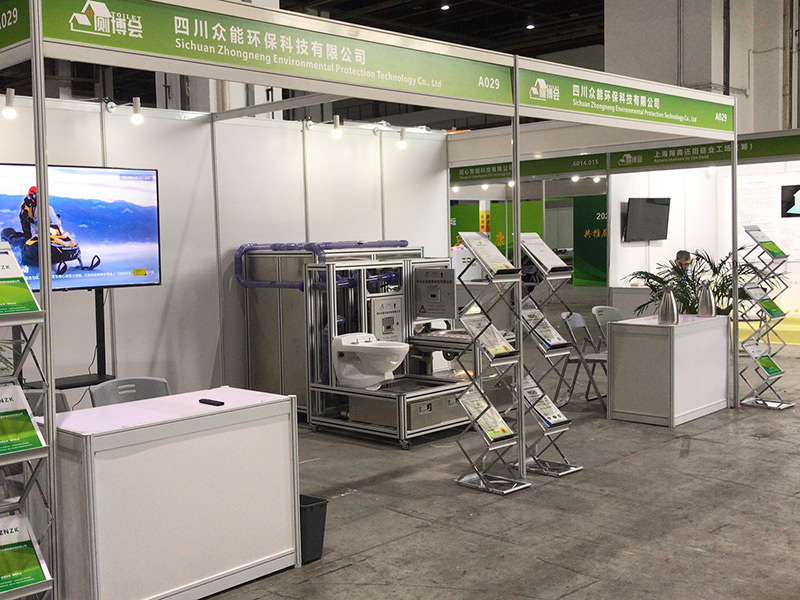

Sichuan Zhongneng Environmental Technology Co., Ltd. (**ZNZK**) is not merely riding the wave—it is architecting the pipeline. Recognized by MOHURD as **China’s largest vacuum toilet supplier**, ZNZK has deployed **over 500 turnkey systems** nationwide, translating to a verified **28% terrestrial market share** (2024 CCID data).

Core Technological Moat

ZNZK’s portfolio is anchored by **dual-valve anti-clog architecture (Patent CN113216347A)** and proprietary low-pressure collection algorithms that reduce power draw to **0.0025 kWh per flush**—**12% below the industry benchmark**. The flagship VTPP-01 stainless vacuum pedestal integrates smart collection tanks and IoT-enabled base controllers, enabling **predictive maintenance** and remote effluent monitoring for fleets of **100+ units**.

Product Dual-Track Strategy

1. Fixed Systems

- Stainless & ceramic vacuum WCs/squat pans

- Modular collection tanks for high-rise retrofits

- Annual water savings: 12,089 tons across installed base

2. Mobile Sanitation Hubs

- 2–6 seat trailerized units; **2,000–3,000 flushes** without external water/sewer

- Operational envelope: **-50°C to +40°C** with integrated heating & insulation

- Full customization: exterior branding, layout, fixtures

Signature Deployments

| Project | Location | Scope | Outcome |

| Beijing–Zhangjiakou HSR | Hebei | 28 onboard vacuum systems | **100% compliance** with CAAC zero-discharge rule |

| Sinopec Shengli Oilfield | Shandong | 6-seat mobile vacuum trailer | **2,600 flushes** over 21 days at **-42°C**; zero freeze-ups |

| Chengdu Tianfu Airport T2 | Sichuan | 84 fixed ceramic vacuum WCs | LEED Gold contribution; **3,400 m³ water saved annually** |

| Yunnan Pu’er Eco-Tourism | Yunnan | 4-seat solar-powered mobile restroom | **2,011 flushes off-grid**; awarded “Water-Saving Demonstration” |

Scale & Customer Archetypes

- Tier-1 Municipalities: Public plaza retrofits (Beijing, Shanghai, Guangzhou)

- State-Owned Energy Giants: Remote hydropower/oilfield camps (CNPC, Sinopec)

- Transport Operators: Onboard & station systems (CRRC, China Eastern Airlines)

- Event & Disaster Relief: **12 mobile units deployed within 36 hours** (2022 Henan flood)

With end-to-end control (R&D, 60,000 m² plant, 42 installation crews), ZNZK achieves **28-day lead times** for mobile units and **99.3% on-time project delivery**. Its ISO 14001-certified recycling reduces embodied carbon by **41%** versus imported alternatives.

The Road Ahead

ZNZK is already piloting **vacuum-greywater recycling modules** that convert effluent into **Class IV irrigation water onsite**, targeting the **RMB 3.2 billion water-reuse retrofit market** opening in 2026. Its Belt & Road playbook—pre-certified for GOST-R and EAEU standards—positions the company to export mobile sanitation hubs to Mongolia’s **-55°C mining camps** and Kazakhstan’s Caspian oilfields by Q3 2026.

In a nation where every liter of water saved is now monetized, ZNZK is not just selling toilets—it is banking **water credits, carbon offsets, and regulatory goodwill**. With over 500 installations as proof and a patent fortress guarding its flank, ZNZK has transformed vacuum sanitation from a niche engineering curiosity into **China’s invisible infrastructure backbone**.

Post time: 08-11-2025